.

The content displayed on this page is intended for guidance purposes only. It is not exhaustive and is constantly being updated to reflect the latest changes. To stay up to date, we advise you to visit this page frequently.

Get your e-commerce business ready for the new VAT rules

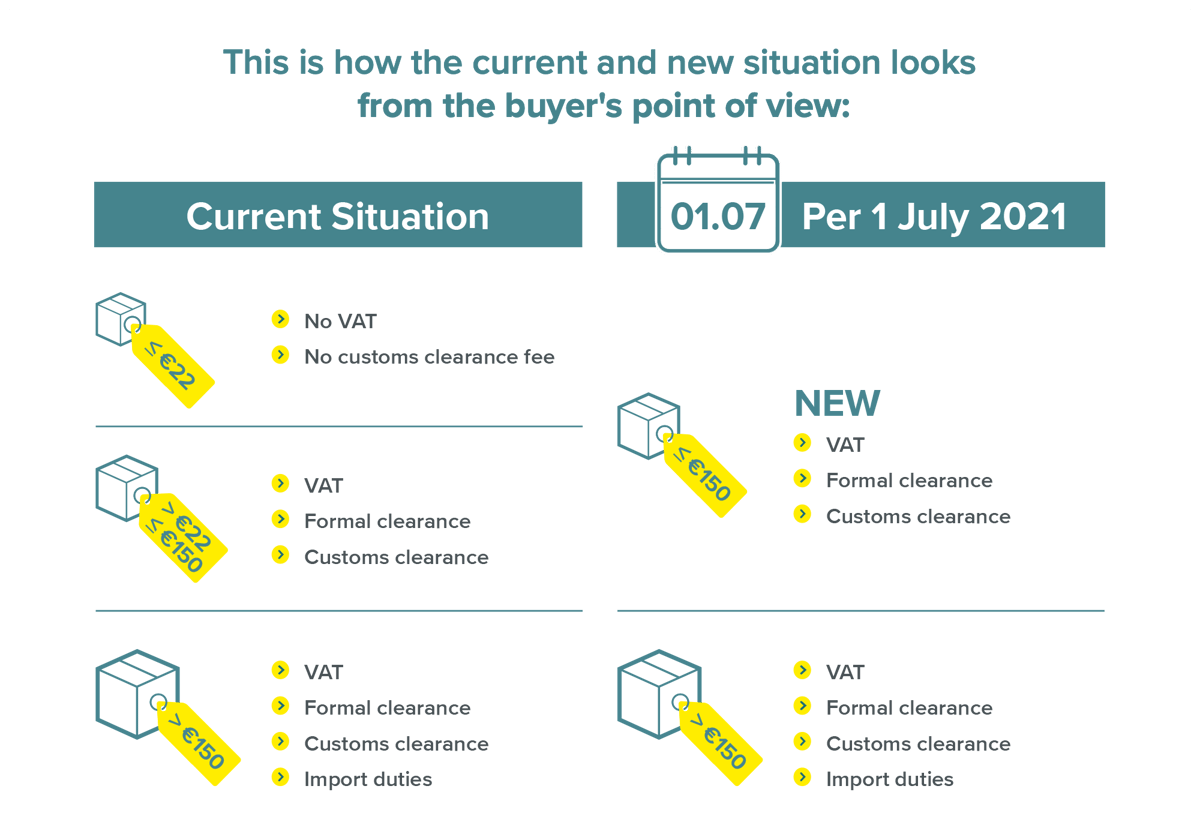

The new IOSS system is being introduced by the EU to simplify VAT for distance sellers in July 2021, alongside the removal of the EU’s low-value consignment relief of €22.

The introduction of IOSS is part of wider EU VAT reforms which are being implemented from 2021 onwards. Currently, both EU and non-EU e-tailers selling to EU consumers can import goods to the EU directly to the consumer without paying VAT if the consignment is valued at €22 or below. This is known as the low-value consignment VAT exemption, or “low value consignment relief”.

This VAT exemption, originally intended to save customs officials the hassle of checking large volumes of packages for minimal tax revenues, left EU-based online retailers at a disadvantage by requiring them to pay VAT for goods dispatched within the EU. The changes to VAT rules in 2021 will level the online playing field, as well as prevent fraudulent declarations attempting to evade VAT payments.

IOSS and new EU VAT rules explained

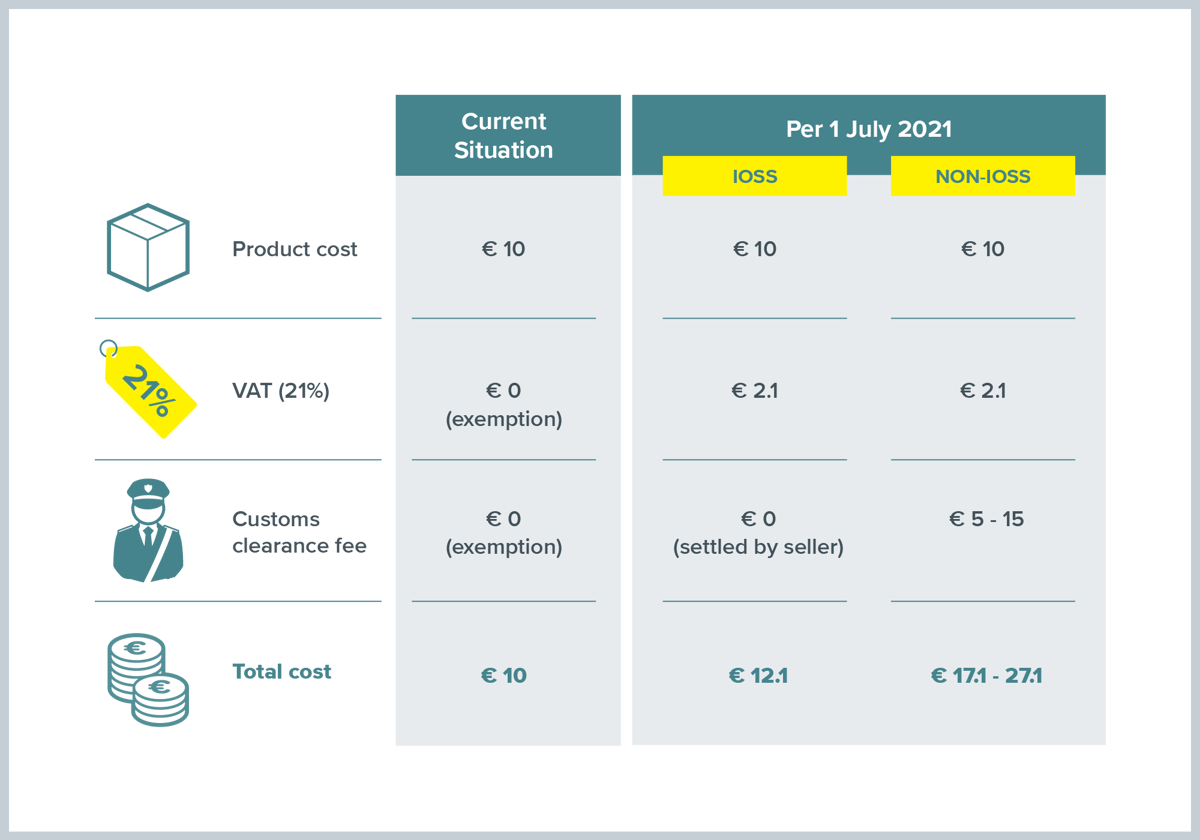

The Import One-Stop Shop (IOSS) provides an electronic portal created to centralise the declaration and payment of VAT for distance sales of imported goods (with a value not exceeding €150), making it easier, faster and simpler. The IOSS means the consumer/shopper is only charged once, at the time of purchase, so there are no surprise fees to pay when the goods are delivered. The VAT rate will be the one applicable in the EU Member State where the goods are to be delivered.

The new VAT rules will affect B2C consignments of standard goods (i.e. not subject to excise duties) imported into the EU and valued at €150 or less. It also means marketplaces will be responsible for charging and collecting VAT, acting as the deemed supplier for low-value consignments.

When do the changes come into effect?

From 01.04.2021

Sellers can register on the IOSS portal from 1 April 2021, but IOSS can only be used for goods sold from 1 July 2021.

From 01.07.2021

The EU is abolishing the low-value consignment relief for standard and reduced VAT goods to the EU from outside the EU.

![]()

How will IOSS affect my e-commerce business?

The simplest way to ensure compliance with the new rules is to register for IOSS.

The new VAT rules require an electronic interface (such as marketplaces or an e-commerce website) to clearly display the amount of VAT to be paid by the buyer in the EU prior to finalising the order, and ensure VAT is collected for goods being sent to any EU Member State.

All shipments will require a customs declaration, will be subject to VAT and must provide full and correct customs data. Remember, this will also include those shipments valued at equal to or less than €22, which are currently not subject to VAT.

Further requirements include (but are not limited to) submitting monthly electronic VAT returns via the IOSS portal and keeping records of sales facilitated by IOSS for 10 years.

What does it mean?

From 1 April 2021, businesses can register on the IOSS portal of any EU member state that has published their registration process.

If businesses are not based in the EU, they will need to appoint an EU-established IOSS intermediary to fulfil their VAT obligations under the IOSS scheme, unless the seller’s country has signed the VAT mutual assistance agreement with the EU (only Norway at the time of writing).

The IOSS registration is valid for all distance sales of imported goods to consumers in the EU.

The intermediary needs to be a taxable person established in the EU: it can be a law firm, authorised economic operator or European-based subsidiary of a non-EU based seller. The intermediary must be registered as an IOSS intermediary.

Yes, Asendia is happy to recommend the right IOSS intermediary for your business; simply contact your Asendia account manager directly.

You can only start using the IOSS scheme from 1st July 2021.

The new VAT rules apply to suppliers of services to EU consumers and sellers of goods to EU consumers (B2C), including marketplaces facilitating cross-border e-commerce. Postal operators as well as couriers will also need to comply with new customs regulations and declaration processes.

An electronic interface can include a website, portal, gateway, marketplace, app or any other system used to facilitate distance sales.

This term refers to the supplies of goods which are either dispatched or transported on behalf of the seller (from a third country or territory), to a consumer in EU Member States.

• If the goods are dispatched or transported from outside the EU at the time they are sold.

• If the goods are dispatched or transported in consignments with an intrinsic value of or up to €150.

• If the goods are not subject to excise duties (e.g. alcohol or tobacco products).

• If the electronic interface facilitates the direct sale of imported goods, or creates a contract between consumer and seller, where the end result of the sale of goods to that consumer.

The intrinsic value is the total value of goods in a consignment at the point of sale, excluding insurance, transport costs (unless they are included in the price and not indicated seperately) and duties and taxes.

No, all consignments equal or lower to €150 of an IOSS registered company must be declared under the IOSS scheme.

No. It is optional but when a company is IOSS registered it must comply with IOSS rules. IOSS will enable non-EU sellers to register in just one EU Member State to centralisie their VAT declaration and payments for all EU-bound shipments.

If you decide not to declare the VAT centrally, the Member State of consumption (the destination country in the EU) will become responsible for collecting VAT on the goods. If you are not registered for the IOSS scheme and are not using any customs prepaid solutions, any import tax and customs duties in the EU country of destination will be charged to the EU shopper upon delivery of the goods. This would considerably impact the shopping experience for your customers based in the EU.

For businesses outside of the EU, it is advisable to register under IOSS and appointing an EU-established intermediary to fulfil their VAT obligations under the IOSS sheme, unless the seller’s country has signed the VAT mutual assistance agreement with the EU (only Norway at the time of writing).

UK based customers might consider waiting to appoint an IOSS intermediary as some discussions are underway between the EU and the UK regarding possibly signing up to the VAT mutual assistance agreement.

You can find more information on the EU Import one-stop Shop here: https://ec.europa.eu/taxation_customs/business/vat/ioss_en

All shipments from the 1 January 2021 will require electronic customs data to be provided by the sender, unless the shipment is in free circulation within the EU. As stipulated by ICS2 (started for post transports in March 2021), without EAD shipments transported by air cannot pass security and customs protocols. This is regardless of whether an item is sent through postal or commercial channels.

A supplier or electronic interface or intermediary using the IOSS scheme should ensure the following in respect of VAT:

• Display a product's price and the VAT on its website;

• Collect the VAT amount when selling online;

• Check on the intrinsic value of the imported goods < €150;

• Mention the VAT on the invoice, distinguishing the different VAT rates

• Provide the customs declarant with the necessary information for customs clearance (including the IOSS VAT identification number)

• Filing a monthly VAT declaration before the end of month M+1

• Remit the VAT collected from the online sale before the end of month M+1

• Keep records of all eligible IOSS distance sales of imported goods for 10 years to cater for possible audits by EU tax authorities. The information to be retained is that provided for in Article 63c(2) of the VAT Implementing Regulation

.png?width=500&name=Asendia-Customs-3d%20(1).png)